If you’re considering making a fintech app, you want to see this post! It’s got everything you need to know: an overview of the fintech industry, tips on the best programming languages and platforms for your new project, and more.

Let’s get started now!

Fintech has revolutionized the world we live in. From being used by the wealthy to help manage their money and investments to helping small businesses access capital and ensuring that middle-class families can save for the future, Fintech has come a long way from its humble beginnings as a simple savings application designed for bank customers.

The “Financial Technology” industry sprang from basic technology developed primarily for financial purposes, such as online banking and accountants. With the influx of smartphones in the late 90s, credit cards were developing at lightning speed, with companies such as PayPal rapidly earning a presence in society. As the Internet grew, so did the idea of online transactions, and innovations such as e-commerce developed. The game changed forever when social media took off in the mid-2000s.

Now, Fintech has taken on a life of its own. Today, Fintech is a sector that encompasses a wide range of services and platforms: from credit cards and loans to crypto-currency investing and mobile banking apps.

Mobile banking apps are used by over 2 billion people worldwide.

The global financial sector is expected to be worth US$26.5 trillion in 2022, with a CAGR of 6%.

The growth in Fintech is expected to continue in the near future and also play a significant role in ensuring that more people can be served by financial services, including those who are unable to access traditional services because they lack appropriate documentation or reach out to regulators. Overall, new fintech innovations will increase competition and innovation within an industry that works to develop and provide financial solutions for people across the globe.

What is Fintech App?

A fascinating aspect of Fintech is its ability to bring together both traditional banking and entrepreneurial thinking and new technological thinking to create an entirely new service model that brings new customer solutions that have never been seen before. Fintech apps are those projects that help people access fintech services. In the current world of Fintech, anyone who can use a smartphone can apply for a Fintech app, a form of mobile banking.

These include smartphone apps for:

1. Identifying financial needs and providing access to information about suitable financial solutions (for instance, credit card processing). This category also includes applications that children use to manage their allowances and ensure that they get what they need.

2. Making payments, including borrowing money and making payments for other people (such as friends or family). In this case, a fintech app may include peer-to-peer lending services.

3. Making investments and managing capital. This may include investment options such as cryptocurrencies or mutual funds, as well as other forms of investment such as crowdfunding campaigns and peer-to-peer lending.

4. Providing financial solutions to the middle-class and lower-income groups to ensure that they have access to credit and lodging services; This includes mortgage financing, business loans, or insurance services, including health insurance and life insurance partnerships with startups who develop health apps.

5. Providing investors or entrepreneurs with a means of accessing funding through crowdfunding campaigns or through a peer-to-peer lending network.

6. Providing users with business solutions such as accounting and payroll software and providing access to financial services and payment processing.

Why Should You Develop a Fintech App?

It is well known that Fintech is a growing industry and has enormous growth potential. From helping people access loans and investment capital to providing new opportunities for credit card payments, cash management, or business accounts, the possibility of fintech apps has no limit.

The fintech industry is rapidly growing, with traditional financial services and technology at its core. The fintech industry includes both startups and traditional financial institutions. It combines the best technologies with new economic models to provide better solutions for users and customers in many different areas: from lending to processing payments, from accounting to payments via wire transfers, online or mobile banking, or even applications such as smart contracts in blockchain technology.

However, developing a fintech app on your own is difficult. That’s why you want to make sure you see this post! I’ll show you everything you need to know about the industry and how you can make the most of your Fintech project. Fintech has transformed businesses and communities and has become one of the most valuable industries in the financial services industry.

Fintech has gone far beyond simply being an industry that helps people manage their money; nowadays, the fintech industry offers new ways for many to invest and make use of financial services to gain access to credit and other financial products such as mortgage financing, personal loans, peer-to-peer lending and many more.

In fact, at this point, Fintech can be recognized as a global industry that not only helps entrepreneurs with new online platforms but also provides people with access to opportunities through crowdfunding campaigns or by giving other funding options.

If you are looking for Fintech App Development Solutions, you have come to the right place. Let’s find out how to develop a Fintech app.

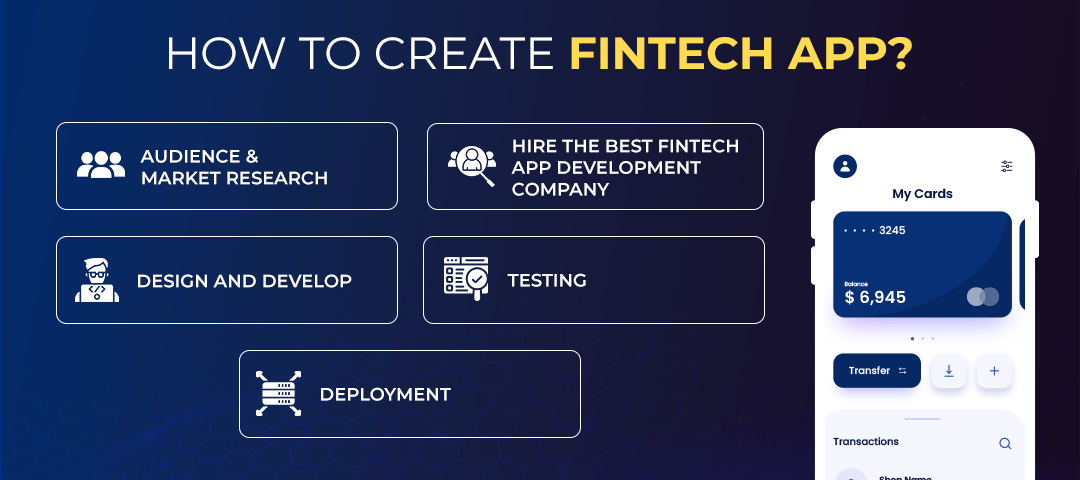

How to Create Fintech App?

Fintech app development is an enormous challenge. People looking to develop a fintech application today need to understand that the most common applications in this field provide users and customers with access to credit for their business, allowing them to make payments and invest in new financial solutions.

Unfortunately, although many fintech apps are designed for managing personal finances and making payments, a solution still needs to be prepared to offer a person access to all financial services in one place. The reason for this is apparent: it takes a lot of work to develop one platform that would work well for everyone.

1. Audience & Market Research

The first step in developing a fintech app is understanding who the target audience is and what they need. This may include people looking for mortgage financing, personal loans, business loans, or alternative credit options such as peer-to-peer lending or crowdfunding. In designing a fintech solution, you also need to consider the type of people you are designing for. If you want to reach out to people who are experienced with fintech solutions, then your product will have to be more complicated. However, if you need to reach people who are “newbies” when it comes to fintech products, then it’s essential to design a fintech app that is simple and easy to use.

2. Hire The Best Fintech App Development Company

Startups and small businesses are usually the ones that want to develop a fintech app. To design a simple and easy-to-use fintech app for beginners, you will need to work with top fintech app development companies specializing in custom fintech app solutions for startups and small businesses. If you are looking for custom Fintech App Development Solutions, we would be the perfect option for your app development partner. We have a team of dedicated professionals who possess the skills to develop result-driven fintech app development solutions. Contact us now.

3. Design and Develop

When it comes to fintech apps, you will also need to consider the designs and functions of the app. Sometimes, an app is just about the design. However, it must be recognized that no app can be completely successful if it doesn’t have an objective function, especially if you want to offer a personal loan or other financial services. Also, design is not everything – the functionality of your product is also essential. You should know that to develop a functional fintech app that offers users real services, you may need additional staff, such as programmers, who can help you create and build the backend systems for your product.

This is very important because it determines what kind of app you will develop:

1. Fintech apps that offer financial solutions such as peer-to-peer lending, making payments, or providing access to credit cards.

2. Fintech apps that offer investment options, including cryptocurrencies and crowdfunding.

3. Hire Fintech Developers that develop accounting and payroll software. This is also very important to understand if you want to ensure that your fintech app or your fintech web app has a robust backend and can handle a lot of traffic.

4. Testing

Testing is also very important, especially if you are developing a product that includes trading and investing. In order to test your product, it’s essential to work with professional testers, which will help you test the functionality of your app and identify any bugs or issues. Fintech app development companies will take the necessary steps to ensure that there are no problems with functionality and that your app is ready to be launched.

5. Deployment

After completing all of the design, development, and testing steps, you will want to deploy your fintech app to users. With the help of a fintech app development company, this will be an easy step because they have experts and developers who know how to ensure your product is launched, set up, and ready for use.

Introducing Fintech in the financial sector was very difficult in some countries, especially those rich in traditional finance. However, with modern technologies such as smartphones and tablets, Fintech has become necessary. Mobile applications are a great addition to conventional banking services because they allow people to access their finances anywhere at all times.

How Much Does It Cost to Develop a Fintech App?

Therefore, it is crucial to know how much it will cost to develop a fintech app after learning how to build one. The cost factor is significant because it will help you determine whether the project you plan to develop is worth investing your time and money in.

When it comes to fintech app development, it’s relatively easy for most people to understand how much a fintech app will cost them: if an app is too expensive, then there’s no way that someone can afford it; however, if an application is too cheap, then the quality of the product will be low, and users won’t be able to get value from it.

An average fintech app development costs around $15000 to $50000, depending on the type of app you want to develop and the features it includes. If you want to know the exact price then feel free to connect with our professionals at admin@auxanoglobalservices.com.

Knowing how much an application costs will help you determine what type of application you can afford to spend time and money on. However, this only tells part of the story.

Suppose we’re talking about a fintech app that helps people meet their financial needs, for example, peer-to-peer lending or crowdfunding. In that case, the cost is lower than what kind of potential users it will attract because this is separate from Fintech development.

Why Choose Auxano Global Services?

As a top-rated Fintech app development company, we offer Custom fintech app development services that help businesses and startups to create unique and innovative Fintech solutions.

We are also specialists in technology and digital marketing, which means that we can help you achieve your business goals using our result-driven digital marketing.

Our clients can be startups, small businesses, and large corporations. They can also use our services to ensure that they comply with all the necessary regulations today.

At Auxano Global Services, we develop custom fintech applications to help you solve your problems and allow you more freedom than ever before. We are one of the best Fintech Developers For Hire, with a team of talented developers and designers who can create the perfect product for your needs.

Our Fintech app developers are pro-tech, so they fully understand how to use the latest programming languages and technologies to bring great ideas to life. Our team is also equipped with the right tools to ensure that these applications will be as attractive, user-friendly, and reliable as possible.

Auxano Global Services has an experienced design team to help you make your fintech app stand out from the crowd and offer the best possible user experience. As the Best Fintech App Development Company, we can provide you with high-quality testing services and ensure that everything is ready to launch.

So connect to us and let us help with your Fintech app ideas.

Conclusion

Fintech app development is a great way to transform your business and make it more efficient, but only if you have the right support.

Although Fintech apps can be an excellent tool for increasing productivity, there are several factors you need to consider before deciding whether or not adoption is a good idea for your company.

Auxano Global Services comprises the best Fintech developers with experts in design and Digital marketing services that will help you achieve your goals and target the audience that you want to reach. We can also develop any fintech application you might need, whether it’s an investment app or one that helps people manage their finances.

Fintech app development has changed the chances of companies who want to bring their product to market and grow their brand. However, it’s essential to be aware that choosing the right fintech app development company is vital because it will save you time, money, and effort.

Among all the available options, Auxano Global Services is one of the Best Fintech App Development Companies with a proven history of developing innovative solutions that help businesses and corporations overcome their problems. If you are looking for a reliable fintech developer for hire, then we are your best choice. Contact us now.

Frequently Asked Questions

-

1. How much does it cost to develop a fintech application?

The price of developing a fintech application depends on multiple factors, such as its features, complexity, and distribution channels. All of these can vary depending on the client’s needs and requirements. An average fintech app development costs around $15000 to $50000. If you want to know the exact cost of your project, it’s best to contact us and ask our professionals about the specific details of your fintech app development.

-

2. How long does it take to develop a Fintech App?

The time required for developing a fintech application depends on the type of application you are developing and its technical complexity. Auxano Global Services has developed many applications from scratch and even helped clients with their particular challenges in this field.

-

3. Where can I get more information about Fintech app development services?

To know more about our Fintech app development services, then feel free to reach our experts at admin@auxanoglobalservices.com or call us at +1.209.736.5046.

![How to Develop a Crypto Wallet App? [Complete Step-by-Step Guide]](https://www.auxanoglobalservices.com/agsresources/wp-content/uploads/2022/08/A-Step-by-Step-Complete-Guide-to-Develop-a-Crypto-Wallet-App.png)