Back then, the overall banking system was slow, inefficient, and not very customer-friendly. The problem was that the traditional banking system relied on a centralized infrastructure. This meant that there was a single point of failure and that the system was very slow.

Moreover, the traditional banking system was very difficult to change. There were merely two major operations of the conventional system — deposits and withdrawals. However, with the advent of metaverse development services, a lot has changed.

Before we dive deep into how can metaverse transform the banking ecosystem, let’s check out some statistics:

According to Accenture Technology Vision reports for 2022, around 67% of global banking decision-makers believe the metaverse will have a positive impact. In addition, 38% of executives believe the metaverse will bring a breakthrough in the banking industry.

As per Morgan Stanley and Goldman Sachs reports, the metaverse economy will cross the mark of $8 trillion and banks will play a pivotal role.

These statistics clearly show that the banking industry is all set to leverage the potential of the metaverse and provide a better experience to its customers. This is the time for banks and financial institutes to think beyond the traditional banking system and employ innovative technologies like the metaverse. With a professional metaverse development company, bankers can create a more agile, customer-centric, and secure banking ecosystem.

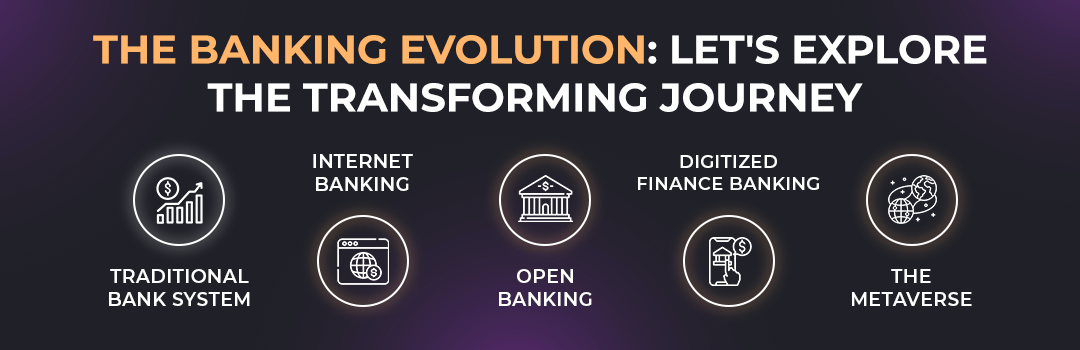

The banking sector has entered the fourth phase of evolution in which technology is playing a vital role. Advanced technologies like NFTs, cryptos and the metaverse are changing the way banks operate.

They are opening up new possibilities for the banking sector and providing a more personalized experience to customers. Some of the banks have already entered the fifth stage of evolution which is the metaverse. On this note, let’s have a quick look at the ground-breaking evolution in the banking industry:

1. Traditional Bank System:

The two-tiered baking system was introduced in the early 19th century. It consisted of a central bank that regulated the supply of money and commercial banks that took deposits from customers and gave loans.

This system was very slow and inefficient as it relied on a manual and a time-taking infrastructure. Moreover, there was a single point of failure which made the system very vulnerable. The high usage of paper-based documentation was another drawback of this system.

2. Internet Banking:

In the last decade, all financial institutes experienced the full-fledged digitalization of the core system. However, this did not change the fundamental structure and operation of banks. They still relied on a centralized infrastructure which made them very slow. digitalization was divided into two categories — first, transforming the existing infrastructure and second, providing new digital services to customers.

However, it was a significant step towards innovation as it made the banking system more customer-centric. It allowed customers to access their accounts, make transactions, and apply for loans online.

3. Open Banking:

Open banking is the latest phase of evolution in which banks are required to share their customer’s data with third-party developers. This data includes transaction history, account details, and loan repayment records.

Open banking is transforming the way banks operate as it allows them to develop new products and services. It also provides customers with more choice and control over their data. Moreover, open banking is very beneficial for small businesses as it allows them to access financing. The last five-year work has been crucial for the banking sector as it has helped them to develop new products, services, and strategies.

4. Digitized Finance Banking:

With the advent of robust blockchain technology, a new phase of banking has started in which banks are providing digitized finance services. This includes digital currencies, NFTs, and tokenization.

Banks are also experimenting with new technologies like 5G, quantum computing, and the Internet of Things (IoT). Moreover, the concept of tokenization is very beneficial for banks as it helps them to reduce the risk of fraud.

5. The Metaverse:

The metaverse is the latest and most advanced phase of banking evolution. It is a virtual world that is created by combining the physical and the digital world. In the metaverse, customers can interact with each other in a more realistic way. This virtual world is very beneficial for banks as it helps them to create a more personalized experience for customers.

Metaverse app development solutions are also very beneficial for small businesses as it allows them to access new markets and customers. Moreover, the metaverse is very beneficial for banks as it helps them to reduce the cost of operations.

As we saw statistics from Morgan Stanley and Goldman Sachs that the metaverse market will be worth more than $8 trillion, the possibilities are immense. Using technologies like augmented reality (AR) and virtual reality (VR), banks can create a more realistic and interactive experience for customers.

Metaverse will solve a lot of problems that customers are facing in the banking industry. For instance, customers will no longer have to visit a bank branch to open an account or apply for a loan.

Still today, conventional banking lacks higher personalization, but in the metaverse, banks can interact with customers on a one-to-one basis. This will help banks to build a more personal relationship with customers.

The metaverse will also help banks to reduce the cost of operations as they will no longer need to maintain physical infrastructure. Moreover, the metaverse will help banks to reach new markets and customers.

Several top-tier banks have sensed the importance of Web3 development solutions and they’ve started implementing interactive solutions. Let’s take some popular examples from top banks across the world:

1. JP Morgan — They’ve introduced an Onyx lounge in the metaverse environment that streamlines cross-border payments. This solution also solves various challenges related to asset creation, trading, and safekeeping.

2. HSBC — HSBC has decided to add more fun-oriented interactive elements to its existing set of systems. They’ve invested in The Sandbox metaverse solution which will develop engaging gaming solutions for esports lovers.

3. Standard Chartered — They’ve also invested in The Sandbox and they are experimenting with a lot of customer-oriented services. Standard Chartered is aiming to create a seamless virtual banking experience to grow its customer base.

Leveraging Web3 development services, banks can develop innovative solutions that will help them to improve customer experience and reduce the cost of operations. Metaverse provides a great opportunity for banks to develop new products, services, and strategies.

These banks have realized the importance of the metaverse and they are working on various solutions. However, there are still a lot of banks that have not realized the potential of the metaverse. If you are a bank and wondering what are the real benefits of implementing these Web3 solutions, let’s look at some benefits.

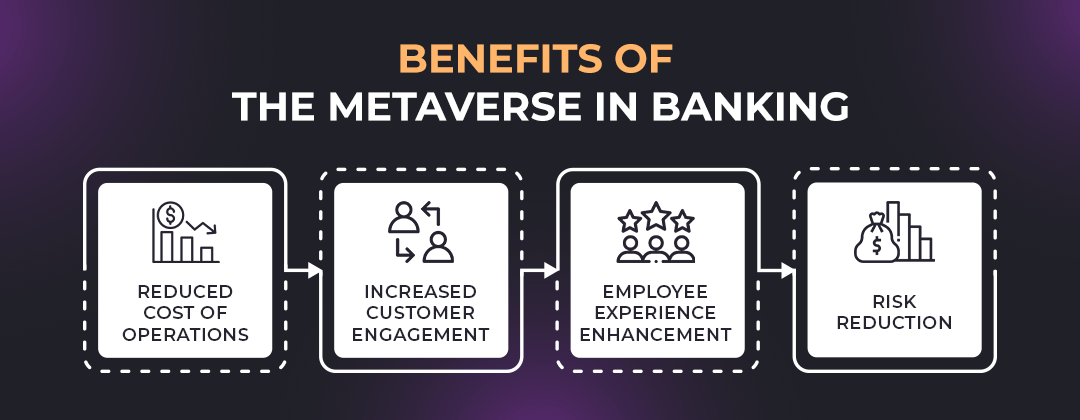

When banks hire metaverse developers, they get a wide array of benefits that helps them to stay ahead of the competition:

1. Reduced Cost Of Operations:

Banks can save a lot of money as they will no longer need to maintain physical infrastructure. In the metaverse, all the operations will be done in a virtual environment. Currently, banks allocate a significant amount of time and funds to maintain their physical branches. In the metaverse, banks can reduce this cost as they will no longer need to maintain these branches.

Another factor that will help banks in reducing the cost of operations is the automated processes. In the Metaverse, a lot of processes will be automated which will help banks to save time and money.

As the customers’ identification details and KYC information will already be stored in the blockchain, there will be no need for banks to verify these details every time a customer wants to open an account or apply for a loan.

2. Increased Customer Engagement:

Customer engagement has always been one of the biggest pain points for banks. The metaverse will provide a great opportunity for banks to interact with customers in a very information-oriented manner. When customers enter the metaverse, they will be able to interact with various bank avatars. These avatars will help customers in understanding the products and services offered by the bank.

Banks will also be able to provide a more personalized experience to customers as they will be able to track their behavior and preferences. For example, if a customer is interested in taking a loan, the bank avatar will be able to provide all the relevant information to the customer.

Moreover, banks will also be able to interact with customers on a more personal level. In the physical world, it is not possible for banks to give the required attention to each and every customer. However, in the metaverse, banks will be able to provide a more personalized experience to customers.

3. Employee Experience Enhancement:

Banks will also be able to use the metaverse to enhance the employee experience. Currently, a lot of banks are struggling to retain their employees. This is because the current banking environment is very stressful and it is not possible for banks to provide a good work-life balance to their employees.

However, in the metaverse, banks will be able to provide a more collaborative and engaging environment to their employees. This will help banks in attracting and retaining the best talent.

In the metaverse, employees will be able to interact with each other in a more efficient manner. They will also be able to share knowledge and ideas more easily. Moreover, they will also be able to take part in virtual training sessions and workshops.

4. Risk Reduction:

The metaverse will also help banks in reducing the various risks associated with the banking industry. For example, banks will no longer need to maintain large amounts of cash as all the transactions will be done in a digital manner. This will help banks in reducing the risk of robbery and theft.

Similarly, the metaverse will also help banks in reducing the risk of fraud. As all the transactions will be done in a digital manner, it will be very difficult for fraudsters to commit fraud. Moreover, the KYC information of the customers will already be stored in the blockchain which will make it very difficult for fraudsters to impersonate someone.

The metaverse will also help banks in reducing the risk of money laundering. Currently, a lot of banks are struggling to comply with the various anti-money laundering regulations. In the metaverse, banks will be able to easily track all the transactions and it will be very difficult for money launderers to hide their tracks.

The metaverse will also help banks in managing the various risks associated with the current banking infrastructure. For example, the metaverse will help banks in reducing the risk of data breaches.

We are the best Web3 development company offering metaverse services. Our team of developers is very experienced in developing metaverse applications. We understand the various use cases of the metaverse and we will help you in developing a custom metaverse application according to your requirements.

Auxano Global Services is committed to innovating and supporting you with the best of our resources, skills, and experience to ensure that your project is completed on time and within budget. Our developers have in-depth knowledge of blockchain technology, and we will help you in developing a banking metaverse application that is secure and scalable.

The metaverse is a new and emerging technology that has the potential to revolutionize the banking industry. The metaverse will help banks to become future-ready and drive more traction. Contact us now to hire Web3 developers and develop a banking metaverse application.

Frequently Asked Questions

-

1. What is a Metaverse in Banking?

A metaverse is a digital world that can be used for various purposes such as banking, shopping, gaming, and social networking. A metaverse in banking can be used to provide a more collaborative and engaging environment to employees and customers.

-

2. What are the Benefits of a Metaverse in Banking?

Some of the key benefits of a metaverse in banking are better customer experience, improved work-life balance for employees, reduced risk, and improved compliance.

-

3. How to Get Started With Metaverse Banking Solutions?

If you are looking to get started with metaverse banking solutions, hire Auxano Global Services. Our team first analyzes your business goals and requirements and then develops a custom metaverse application for you.

-

4. What is the Future of Metaverse Banking?

The future of metaverse banking looks very promising as a lot of banks are already testing the waters with metaverse banking solutions. In the future, we will see more banks adopting metaverse banking solutions to provide a better experience to their employees and customers.

-

5. How much does it Cost to Develop a Metaverse Banking Application?

The cost of developing a metaverse banking application depends on the features and functionality you require, the overall complexity, and the scalability.