With technological advancements, we live in a digital era where almost everything is possible virtually. Transferring payments online has become easier than ever. There are several options like E-wallets, bank transfer, UPI payments and gift cards. What if you could have a much more reliable, innovative and user-friendly application to make your payments? Yes, you heard it right. We are talking about the Peer to Peer Payment application.

Payment apps are very convenient and easy to use. It is one of the most revolutionary ideas that change the payment transfer process, now people can instantly transfer payments, bills, recharge, and many more using payment apps.

Being a leading payment app development company, we are well acquainted with the latest technology advancements. In this particular article, we are explaining what a P2P payment app, types of payment apps, and how to build payment apps? Before diving into the depth, let’s talk about top P2P payment apps worldwide.

Top Payment Apps Worldwide 2021:

What is a P2P Payment app?

Think of P2P as person to person. This app allows you to transfer money from one bank account to another. You can make payments for car rides, food orders, online shopping, client dues and much more. This innovative app idea has gained popularity globally. Several companies have created P2P payment apps that are running successfully in different countries. It is expected that by the end of this year, the P2P industry will grow $330 billion.

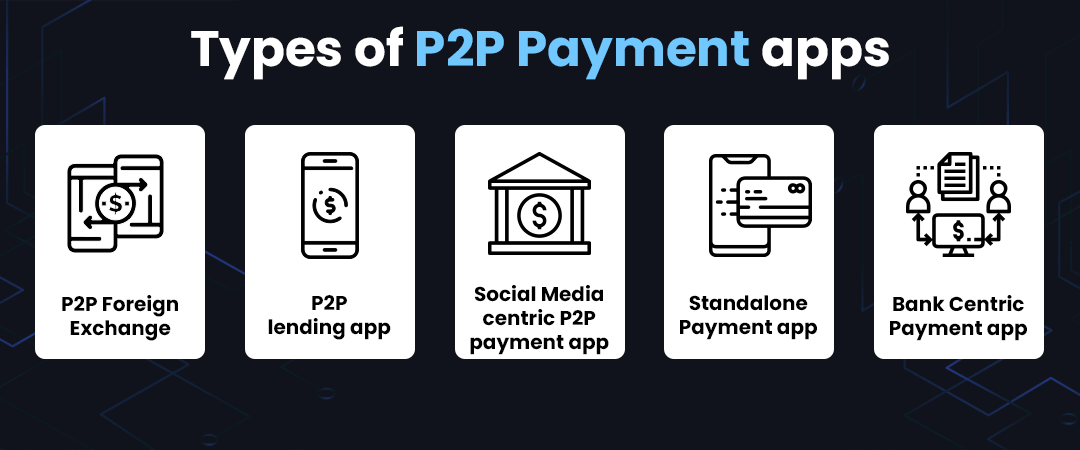

Types of P2P Payment apps

P2P Foreign Exchange

This is a foreign exchange payment app which provides currency exchange cutting off the intermediaries. This means that the consumer can save around 50% money on the transaction fees.

P2P lending app

This model focuses on offering micro-loans at an interest rate which is lower than the banks. This option is beneficial for someone who wishes to monetize their coffers.

Social Media centric P2P payment app

If you take a look, there have been several social media companies which created a P2P payment app. For example, Facebook has a payment option attached to Messenger which lets users transfer funds on the apps.

Standalone Payment app

This is one model where you can make transfers in a standalone app. This means that the app would have an offline wallet where users can store their funds before offloading it. PayPal is the leading app for such models, working in more than 200 countries.

Bank Centric Payment app

Here, the bank becomes a transactional party. This app is divided into two categories: the first one has the mobile app for making transactions and the other one lets you transfer money through a partner bank. For example Zelle and Popmoney.

How to build a P2P Payment app?

When it comes to building an intuitive app with unique features and a user-friendly design, you need an experienced team of developers, designers and programmers. At Auxano Global Services, you will find your dream team. Below listed are the features that you must include in your P2P payment app.

1. Fingerprint Security Lock

There are always concerns regarding safety when it comes to a payment app. Since it may contain bank and other important credentials, a finger lock system is crucial. This will prevent anyone from misusing the app,i.e., only the owner of the device will access the app and make payments.

2. Bank Transfer

Ensure that your mobile app is flexible enough to send money to a bank account through a smartphone. This depends on the type of model you choose for your P2P payment app. You can add a charge for payments like Paypal or avoid any kind of transaction fee.

3. Notification

Push notifications are essential, especially in a payment app. It lets you know immediately when you make a payment or someone transfers your money. It would also alert you for unknown logins or strange payment requests. Some apps add a notification for the bill’s due date which can be a good reminder for those who keep forgetting to pay their bills on time.

4. Unique ID

Before making a transaction, every reliable app sends an OTP or an ID that is just known to the owner. This feature is very important to maintain the security of the money transfers. Let your developers know what you’re exactly looking for.

5. Transaction History

Another essential feature is to add transaction history. This helps the user to know the previous transactions made and gives a clear understanding of the money spent or saved. Also, it helps them as proof in case of any conflicts with the other party.

Hire P2P Payment App Development Company

When it comes to building an effective P2P payment app, you need a team which has the required tools, technology and hands-on experience. Auxano Global Services is one of the most trusted P2P app development company. We have worked with several companies globally creating mobile apps for different sectors. We take pride in delivering promising results and meeting deadlines. We are eager to work with you and build one of the best P2P apps for your business. Let’s start discussing your unique idea immediately. Get in touch with us now.

![Angular Vs. Rеact: What to Choose For Your Blockchain App? [2024]](https://www.auxanoglobalservices.com/agsresources/wp-content/uploads/2023/11/Front.png)