With the onset of the pandemic, mobile applications have made a significant place in our lives to complete daily tasks whether it is for grocery shopping, budgeting, entertainment, or fitness. Mobile applications are even coming in handy when it comes to personal finance. As a result, in the last few years, the market of investment apps has soared highly.

According to App Radar, the top ten investment apps in the UK have managed to garner 1.6 million users since March 2020 which brings the total number of users to more than 3.2 Million. According to Statista, the total number of app downloads globally reached 178.1 billion in 2017. There is a seismic shift being noticed in the way people manage their finances including personal investment and trade.

Gone are the days when only a few people, the wealthy ones used to professionally invest in the different markets. Now with financial education on the rise and numerous fintech applications taking over the markets, investment apps are reaching new summits every day.

What is an Investment Application?

Investment applications are software applications that let users invest in different markets, funds, and trusts and create an investment portfolio. The only thing you are required to do is to create the account and build an investor profile for yourself.

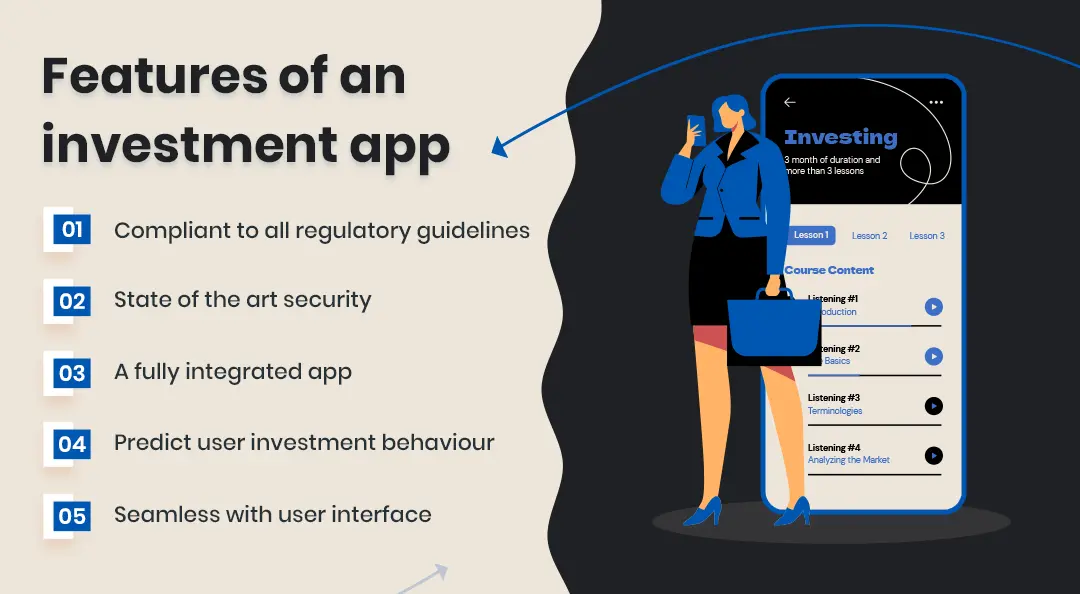

What Are The Key Features Of An Investment App?

The competition in the investment app market is getting more intense. Due to the rise of digital platforms, many people are choosing to manage their money and stock trading independently. You must consider the following features to enable your mobile investment app to stand apart and be tall from the mixed bag of applications already present and operating in the market.

Compliant With All Regulatory Guidelines:

While designing the app you need to confirm that it complies with all the regulatory guidelines of your jurisdiction. These guidelines should also be communicated clearly and explicitly to the users as well.

State-of-the-art Security:

The app must have state-of-the-art security just as good and effective as security practiced by banks.

A Fully Integrated App:

An investment mobile application should have all the features starting from the options to invest in different markets, details about the investment prospects, and a gateway to practice the transactions and investments on the go.

Predict User Investment Behavior:

The app should be able to keep the complete track and history of the user’s investments and should also be intelligent enough to predict user investment behavior and then present suitable investment and trading recommendations.

Seamless With User Interface:

Not only the app should be available on all platforms but also be seamless with user interface and feature push notifications to increase user interface.

What Are Some Of The Best Investment Apps?

Following is the list of some of the top investment apps and details including their key features:

The app is a house for more than 40,000 investment options in the UK and overseas. The platform charges no trading feed for its regular investing services.

When you use Youinvest, you get access to numerous investment options in the form of shares, ETFs, funds, and various types of trusts which you can manage through web and mobile apps.

This app allows you to invest in thousands of options from the UK and overseas whether they are shares, mutual funds, or ETFs that too with a nominal fee.

Moneyfarm is an investment app that boasts of harboring seven risk-rated portfolios that you get recommended basis your profile. Not only you can connect with the consultants in person through the app you can also get free advice from them.

How To Develop An Investment Platform?

Any mobile app development process goes through some pre-set steps of project planning, budgeting project scope development, deployment, and lastly maintenance. One of the most important things while designing an investment app is to make sure that your application stack and platform are interchangeable. I will be expounding on this fact in the paragraphs below.

Conceptualizing The Investment App- A Platform or An Application:

There are generally two aspects of mobile app development. There is the platform design which is a piece of software that keeps on aggregating data in the back end and everything that comes under the front end and user interface is part of the application.

It is important to ensure that logically the investment platform and the investment app should be fully integrated. If they are not integrated, then logic needs to be coded every time you need to introduce the application on a new platform which can be iOS, Android, Microsoft, etcetera. Also, every time you will need to update the application you will have to spend an almost equal amount of time to update each and every platform, and the testing in the live environment is going to be a tedious task.

What Should Be The Approach To The Design of an Investment Mobile App?

Even if you have a pre-existing online trading platform, looking at the market trends, you should plan to create a mobile-oriented or mobile-first design. It is also recommended to do agile prototype testing to check how well the application serves the customers.

User testing helps in discovering some user interface and user experience tricks that can help you turn your mobile application a star among the other pre-existing investment mobile applications. For example, if you want to create charts and projections for the performance of a particular stock, user testing will help you identify what kind of charts and projection types suit the best user. Hence, it enhances the user experience and increases the frequency of using the app.

What Are The Technical Aspects Involved In The Creation of a Mobile Application That is To Be Used For Investment Purposes?

One of the crucial tasks while creating an investment application is that you need to incorporate it with the investment-type data feed for stock markets, debt markets, and mutual funds, to get live performances, indices, and future projections of these markets.

Listed Below Are Some Of The Most Popular APIs Storage:

While some APIs have expertise in providing live data on stock markets, mutual funds, and gold markets others excel in providing data on currencies, etcetera.

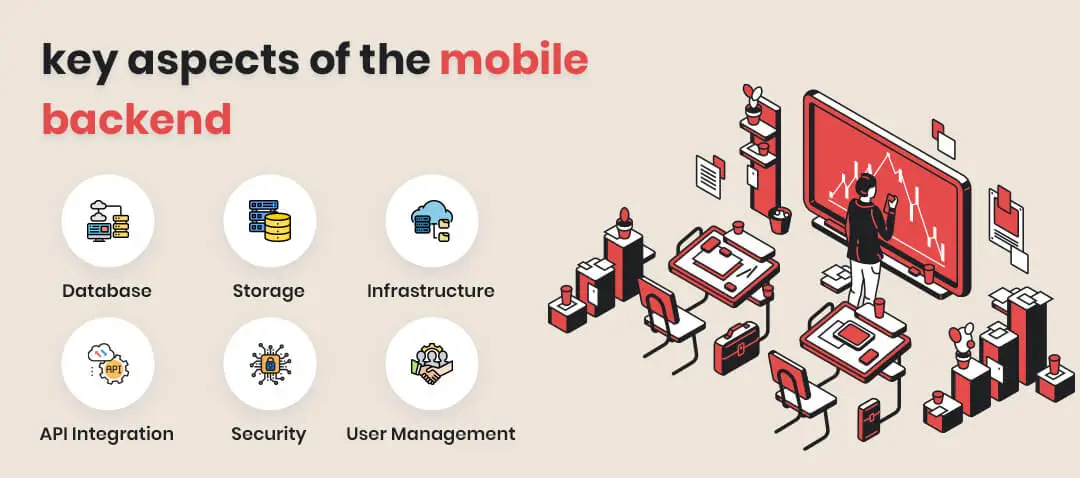

Now that we have addressed APIs and their importance above, we must now focus on the mobile backend. The development and management of the mobile backend are quite time-consuming. For this purpose, an MBaaS provider is recommended that can easily manage key aspects of the mobile backend.

Key Aspects Of The Mobile Backend

- Database

- Storage

- Infrastructure

- API Integration

- Security

- User Management

You can get a better return on your investment by choosing a mobile backend as a service (MBaaS). There are various advantages of this approach such as lower development cost, better performance, better security, etc.

How Important Is Testing In The Development Of An Investment App?

It would be a gross misjudgment to underestimate the importance of testing while you’re creating an app for trading and investment. Apps based on financial technology cannot afford any kind of bugs because the presence of bugs or glitches can make users lose tons of their money which they invested only after years of savings. The testing should be applicable for every step and interface whether it is at the integration of API level or if it is required for user interface and transaction gateway. One can ensure error-free application by deploying special tools like sailfish which are specifically created for MTF, exchange, and brokerage system testing.

Deployment and Maintenance of the app:

Once you have run all your tests successfully after creating the application, it is time to deploy the application on the user platforms. To target a wider base, you need to make sure that your app is compatible with all the major mobile operating systems like iOS, Android, and Microsoft. Once, the app is accessible to the users, comes a major responsibility to keep the app running haplessly keep it up to date, and be in constant housekeeping.

What Is The Right Project Management Approach To Developing Investment Apps?

Scrum is the most popular iterative development technique belonging to an agile methodology which is highly recommended for developing investment apps. The PM coordinates with the team members to draft the features and requirements in the product backlog. The scrum master then plans and executes the sprints based on the estimates and the MVP. The sprint review meeting is conducted when the features are ready. This meeting helps the project stakeholders approve the features. The team then conducts a lessons-learned exercise to help them improve their performance.

How Much Does Developing An Investment App Costs?

Costs involved in the process of developing an investment app are largely dependent upon the IT team you employ. Generally, the costs are in the bracket of $15000 to $60000 depending on the team that you employ and the kind of feature pack you are trying to create. This is a large sum of money for the creators, so they approach potential investors to seek investment. To woo the investors, it is always a good strategy to get a prototype ready to demonstrate your idea which costs a lot less. The prototype you get through a mobile app development company can be quite interactive in terms of user interface and experience which is an added benefit.

What Should Be The Structure Of The Team Involved In Developing The Investment App?

While it’s possible to start with just a couple of developers, you’ll need a wider team to develop a full-fledged app especially with the members having experience in UX, QA, and DevOps. In addition to this, you also need a project manager who can manage a Remote Developers Team. This is also an essential skill for a good project manager.

How To Find Investment App Developers?

For this task, there are two ways to go by. Either can hire freelancers through the hiring platforms or you can hire well-established companies to do the job. Auxano Global Services is a giant in the mobile application development industry that provides integrated, end-to-end, and full-stack mobile application solutions to help businesses and their idea grow and reap a profitable return on investment by incorporating state-of-the-art technology able to compete in the dynamic market.

The onset of the COVID-19 pandemic has brought in a tectonic shift regarding dependence on mobile applications. Recent reports suggest that the financial technology sector will reach new heights in the coming years in terms of growth. It is becoming a hot outfit for the investor to invest their money which assures a guaranteed return. The right investment app idea coupled with an efficient team can create an investment app that will have the huge potential to get popular among new investors and can create ripples in the industry.